Long legged doji how to#

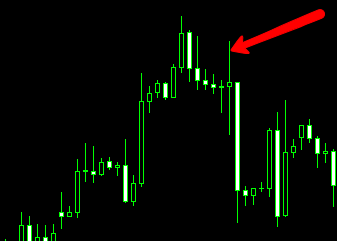

I will talk about how to trade using Long-Legged Doji later in this post, so keep reading. If Long-Legged Doji appears after a strong bullish move means at the top of the uptrend then the pattern will be classified as a bearish trend reversal signal or if Long-Legged Doji appears after a strong bearish move means at the bottom of the downtrend then the pattern will be classified as a bullish trend reversal signal.

In simple words, Long-Legged Doji indicates indecision and if the pattern appears at the top or bottom of the trade then it indicates a trend reversal. Open=Close means both the bulls and bears are not sure about the market direction that’s why they are not aggressively operating in one direction hence the market closed at the opening price level. The opening and closing of the candle should be the same or almost the same means the candle should have no real body.Īs I said earlier, the pattern forms when a candle’s open and low are the same with long shadows on both sides.Both the shadows of the candle should be long.The pattern should look like (+) with long legs on both sides.The pattern forms when a candle’s open and close are the same or almost the same with long shadows on both sides which indicates indecision in the market.įor Long-Legged Doji to be valid, the following conditions need to be met. Long-Legged Doji is a candlestick pattern, which is one of the 5 types of Doji candlestick patterns belonging to the clan of single candlestick patterns. Limitations and reliability of Long-Legged Doji.Long-Legged Doji in the middle of an uptrend and downtrend.What is the psychology behind Long-Legged Doji formation?.

0 kommentar(er)

0 kommentar(er)